The latest prediction by BoF and McKinsey & Company has revealed: In 2019 and 2020, the fashion industry will grow slowly with the change of models between consumers and fashion systems!

According to the research reports found at The State of Fashion 2019 and the new report published by BoF and McKinsey Fashionscope, 2019 is forecast to become a year of awakening for the fashion industry, when the market is going down. China, for the first time in decades surpassed the United States to become the world’s largest fashion consumer market. Industrial growth is expected to slow down from 3.5% to 4.5%, which is quite low compared to that of 2018. Let’s discover the reason with Bizzvn

Consumers in China are increasingly willing to spend more on fashion products.

Global fashion brands will slow down

Most executives who are managing segments from different regions are pessimistic about dealing with the volatile and unstable situation of the global economy in the new year. Trade risks as well as slow economic growth in developed markets in Asia, will negatively affect and weaken the prospects for global market growth in general, as Brexit event pushes Europe into an economic crisis and a profound impact on the world today.

Imran Amed, a founder and editor-in-chief of BoF, said: “The optimism can still continue to be sustained in North America in the luxury fashion segment. But this market is too small to change the global economic landscape and consumer behavior as well as fashion systems.”

Reports on global fashion trend

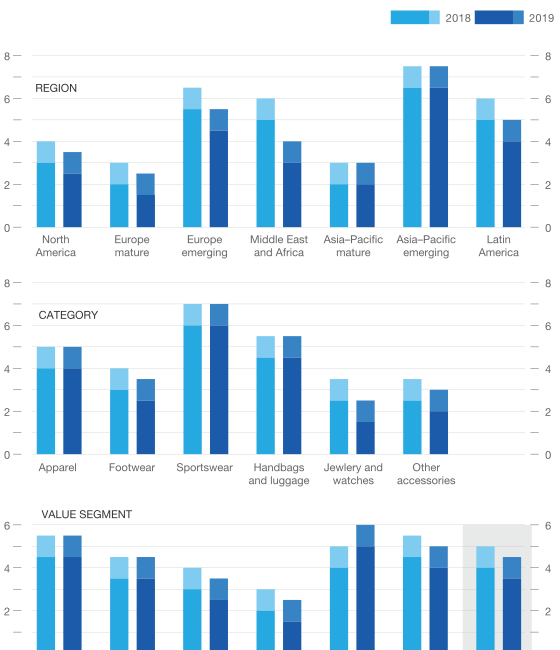

Achim Berg, a partner and senior expert on luxury fashion brands at McKinsey & Company, said: “Based on segments, high-end fashion brands still maintain their performance in 2019 and the level of growth from 5% to 5.5% or 6%. The value is primarily driven by competitors that outperform the competition in the middle segment market. On the other hand, luxury brands will be promoted in the Asia-Pacific market and continue to boom in global tourism.”

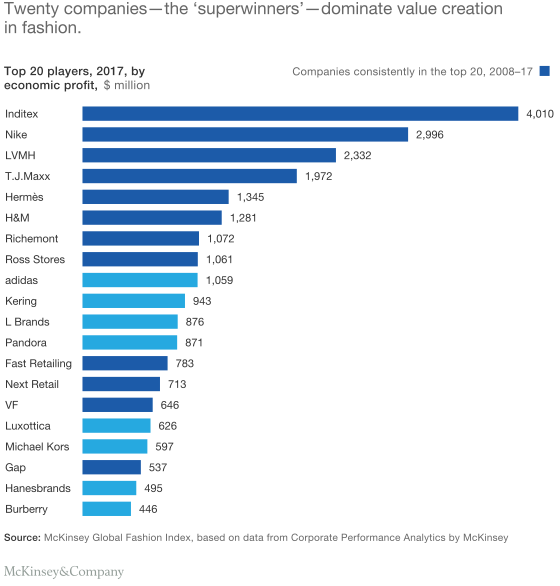

The report also notes the rise of “super winners” that dominate the industry and continually create more sustainable values. This group includes Nike, LVMH and Inditex that are currently holding $25 billion in economic profits, accounting for 97% of the total value of the industry compared to 70% of that in 2010. Over time, department store has gradually lost its place, not a name in the top 20 compared to 3 supermarkets about 10 years ago. On a side note, online retailers are still not in the premium category and there aren’t any brands in the top 20.

The McKinsey Global Fashion Index (MGFI) in McKinsey’s database of 500 private and public companies allows them to analyze and compare the situation and performance of companies based on item, segment and region. For 3 consecutive years, this is a resource for them to continue building.

Fashion brands cannot sleep on the laurels when the market continues to be dominated by crazy turmoil in the global economy, consumer behavior and fashion system.

2019 will be marked as a historic year of the fashion industry. And besides challenges, there are also opportunities. For Europe, the struggling segments will be in the mid-end market. Foresight companies will realize automation and AI. Consumers support or break a brand based on trust.

The 10 trends below act as a schedule to follow for the fashion industry in 2019.

1. Prevention is better than cure

The declining economic index in the fashion industry makes businesses keep a more cautious state. In anticipation of the possibility of a global recession that will be taking place in 2020, companies are increasingly looking at opportunities to increase performance faster than previous years.

2. New Indian breeze

India is becoming the focus of the fashion industry as middle-class customers are expanding aggressively, leading to the development of products for this segment. Fashion brands need to redouble their efforts in these challenging and up-to-market segments, where education and technology savvy are growing.

3. Trade 2.0

All companies need to prepare contingency plans to cope with shocks in the global value chain. On the one hand, apparel trade may have to be redefined by barriers, trade tensions as well as instability. On the other hand, new opportunities from Africa-South America trade and trade agreement negotiations can change the picture.

4. Termination of ownership

The longevity of fashion products is increasingly elastic, while pre-owned business models (already used by others), repairs and rentals are continuing to grow. Fashion brands will have to penetrate this market to reach new consumers, including those who can afford and avoid ownership of clothing forever.

5. Business ethics

The younger generation increasingly shows a keen interest in environmental and social issues. This is also the motivation for brands to bend the steering wheel and pay more attention to this customer segment. They are the ones who will support the brand that upholds corporate social responsibility and business ethics.

6. Now or never

In the era of technological development, the gap between discovery and purchase becomes a pain for patient and meticulous fashion consumers. They are people who want to find products accurately and quickly. Therefore, brands need to focus on closing this gap through shortening fashion, improving the availability of advertised products and new technologies such as visual search.

7. Complete transparency

After years of personal data owned and processed by businesses, consumers are hard-pressed to expect companies to respond transparently and share clear information. Companies that want to trust their customers need to meet greater transparency, both in terms of value for money, creativity and data security.

8. Innovation

Traditional brands are gradually putting on a new layer of their own including business models, images to attract more customers who are hungry for innovation. It is hoped that many brands will continue to follow this innovation, which will have a huge impact on their operating model.

9. Digital participation

The race is becoming increasingly compelling for brands to focus on e-commerce to make value-added products profitable. Through forms of acquisition, investment, research and internal development (internal R&D), these brands need to diversify their ecosystems, consolidating their leading position to outperform companies. Only rely on retail profit.

10. On-demand (On request)

Automation and data analysis allow a startup team to achieve order-based production as quickly as possible. Big brands also need to embark on testing to meet consumer trends and needs, in order to reduce overcapacity and mass production in short cycles.